Dental Implant treatment and reimbursement from insurance

Are you capturing all the potential insurance reimbursement when performing implant related services?

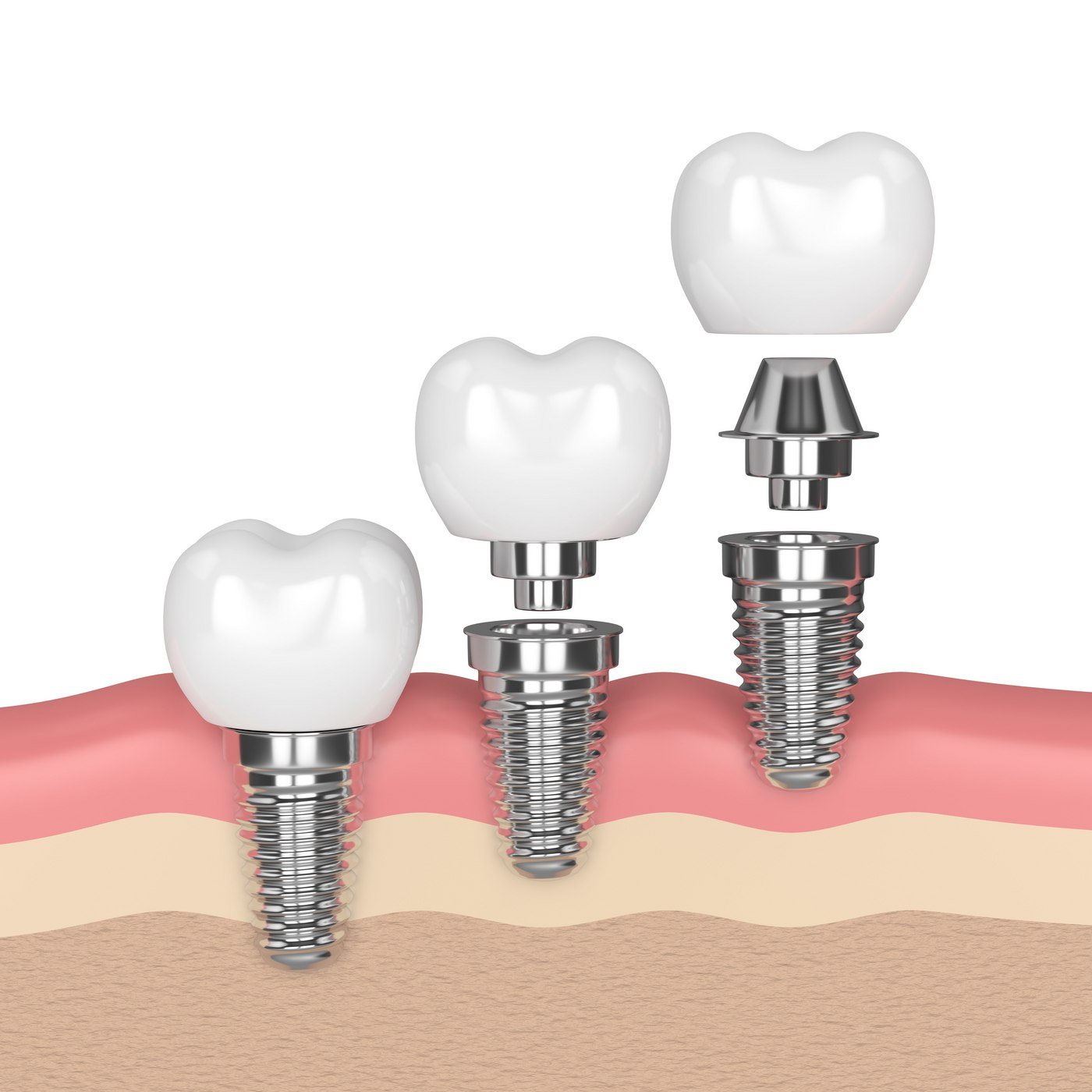

Accurate reimbursement begins with accurate coding. There are many components associated when restoring dental implants. It is important to document each component, as applicable to ensure the highest possible reimbursement. This article will focus on implants restored with single crowns and retainer crowns associated with fixed partial dentures (bridges).

I’ve assisted thousands of dental team members with coding and claim challenges over the past 7 years. Without a doubt, the most common coding error is documenting, and reporting implant and abutment supported crowns and retainer crowns. There is a difference in abutment supported and implant supported terms.

Register now for the webinar on Implant Services: Navigating the Codes

Abutment Supported Restorations

An abutment supported crown or retainer crown is directly supported by a separate abutment, gaining its strength and stability directly from the abutment. The abutment can only be reported separately when it is placed on the implant as a separate component. Meaning it is placed on the implant separate from the crown or retainer crown.

Implant Supported Restorations

An implant supported crown or retainer crown is directly supported by the implant body. There is no separate abutment between the implant body and the crown. While, many dentists are utilizing an abutment for these types of restorations, the abutment cannot be reported as a separate procedure.

Allow me to explain further. The abutment utilized may be a custom abutment or a prefabricated abutment. The abutment in this case, is bonded or milled with the crown or retainer crown. Basically, the abutment and the crown or retainer crown is placed in the mouth, affixed to the implant body as one component.

I know, your next thought is… “but I have to pay for that abutment, so I should be able to report it.” Unfortunately, the abutment cannot be reported as a separate procedure as the crown and retainer crown codes are defined in CDT. As explained already, the abutment must be placed on the implant, a component that is separate from the crown or retainer crown.

So, how can we be properly reimbursed for the abutment used in conjunction with implant supported restorations?

My experience has been that the standard practice fee of the average restorative dentist is the same or close to the same fee assigned for an implant supported restoration and an abutment supported restoration. Dental plans and payers alike, use fee data captured from the fees submitted on claims as their guide to set their PPO allowable fee and the plan usual and customary UCR plan allowable. So, if we want PPOs and dental plans to increase their maximum allowable for implant supported restorations, we should evaluate our standard practice fee for these procedures. Be sure that your fee charged for the service adequately reflects the cost of the abutment, the restoration, and chairside time.

Register now for the webinar on Implant Services: Navigating the Codes

Can I improve my PPO fees for implants?

For the PPO dentist, you might consider reaching out to your PPO to negotiate fees for implant supported crown and crown retainer restorations.

Now that you understand the difference in abutment supported single crowns and retainer crowns, locate these code sections within the implant services category of CDT. There are four subcategories:

- Abutment supported crowns

- Implant supported crowns

- Abutment supported retainer crowns

- Implant supported retainer crowns

Within each of the four subcategories, each restoration is reported based on the material used in fabrications (i.e., porcelain fused to high noble alloy, porcelain ceramic, etc.). It is important to accurately report the restoration based on the material used because plans reimburse at different levels based on the material used. Additionally, be sure to document the material accurately. Porcelain fused to metal or PFM is not adequate documentation. When reviewing your documentation, ask yourself, does my documentation clearly communicate the type of alloy (metal) and/or the type of porcelain/ceramic material used? The clinical documentation must match the dental laboratory prescription.

Learn more about implants through the Dental Claims Academy webinar

There are many other components and implant related procedures than what we have discussed today. Invest in team training to ensure you are reporting accurately for not only reimbursement but coding compliance. Join us for our in-depth implant services coding webinar on May 11,2021. If you are reading this after May 11, 2021 you can watch the webinar on demand and still receive 1 CE credit.

Related Posts

Dental revenue resources from Dental Claim Support