Thinking of Buying a Dental Practice? 3 Tips Every Dentist Should Know

Buying a dental practice is one of the most exciting milestones in a dentist’s career, and it can be intimidating, too. In theory, ownership promises autonomy, long-term income potential, and the chance to build something that’s truly yours. In reality, it also introduces financial pressure, operational complexity, and risk that many dentists haven’t been trained to evaluate.

Buying a dental practice is one of the largest financial and operational decisions a dentist will ever make and also the trickiest to navigate.

Unlike an associate role, practice ownership exposes you to risks that don’t show up on a production report: inconsistent collections, fragile systems, staffing instability, and hidden operational debt. What looks like a “successful” practice on paper can quickly become overwhelming if the foundation isn’t sound.

We’ve worked with many dentists before, during, and after a practice transition. And time and again, we hear about the same challenges that surface after the deal is signed.

This article is designed to help you avoid those surprises by slowing the moment down just enough.

Instead of rushing toward a purchase because the timing feels right or the opportunity feels scarce, we’ll walk through a practical, experience-driven checklist to help you evaluate whether a practice is truly positioned for sustainable success.

The goal isn’t to scare you off ownership, it’s to help you step into it with clarity and confidence.

Key takeaways for buying a dental practice:

- Strong production numbers don’t guarantee healthy cash flow—collections and write-offs tell the real story

- A practice’s systems and people often matter more than its location or equipment

- The right advisory team can protect you from costly mistakes before you ever sign a contract

Tip #1: Look beyond production and assess true financial health

Production numbers are often the first thing buyers look at, and for good reason. They offer a snapshot of how busy the practice is and how much dentistry is being performed. But production alone doesn’t tell you whether the practice is financially healthy or operationally fragile.

What matters MOST is how much of that production actually turns into collected revenue.

A practice can look impressive on paper while quietly struggling with delayed insurance payments, mounting accounts receivable (A/R), or excessive write-offs.

This is where many first-time buyers feel blindsided. Monthly loan payments don’t wait for insurance carriers to respond. Payroll doesn’t pause because claims are aging. Cash flow gaps create pressure fast.

To understand the true financial picture, dig into:

- A/R aging reports to see how much revenue is sitting unpaid and for how long

- Overhead trends to understand fixed versus variable costs

- Write-offs to identify whether revenue is being lost due to process issues or payer behavior

High A/R isn’t just an accounting problem—it’s an operational signal. Practices with unresolved aging often force teams to choose between patient care and collections, which creates stress and burnout over time. You can explore that tension more deeply here: Dental patient care or tackling high dental A/R: Which is priority #1?

Overhead trends matter because they determine how much margin for error the practice actually has. Fixed costs like rent and payroll don’t shrink when collections slow, and variable expenses often rise during ownership transitions. If overhead is already tight, even small disruptions can quickly turn early ownership into a cash-flow problem rather than a growth opportunity.

Write-offs deserve equal scrutiny. Some are contractual and expected. Others signal deeper problems—missed follow-ups, coding errors, or inconsistent billing workflows. Over time, those losses quietly erode profitability. Write-offs at the dental office: do’s and don’ts of writing off payments

Red flags to watch for during due diligence include:

- Large balances sitting in 90+ day aging buckets

- Inconsistent or undocumented write-off policies

- Heavy reliance on a single insurance payer

- Revenue spikes without corresponding collections

If you’re evaluating a specific practice, this is where a free Collections Analysis can be invaluable. At DCS, we help prospective buyers understand what’s actually collectible before you inherit the problem.

Tip #2: Evaluate operations, systems, and people—not just the facility

It’s easy to be impressed by modern operatories, updated technology, or a great location. Those things matter but they’re also the easiest to replace.

What’s harder (and far more expensive) to fix are broken systems and fragile teams.

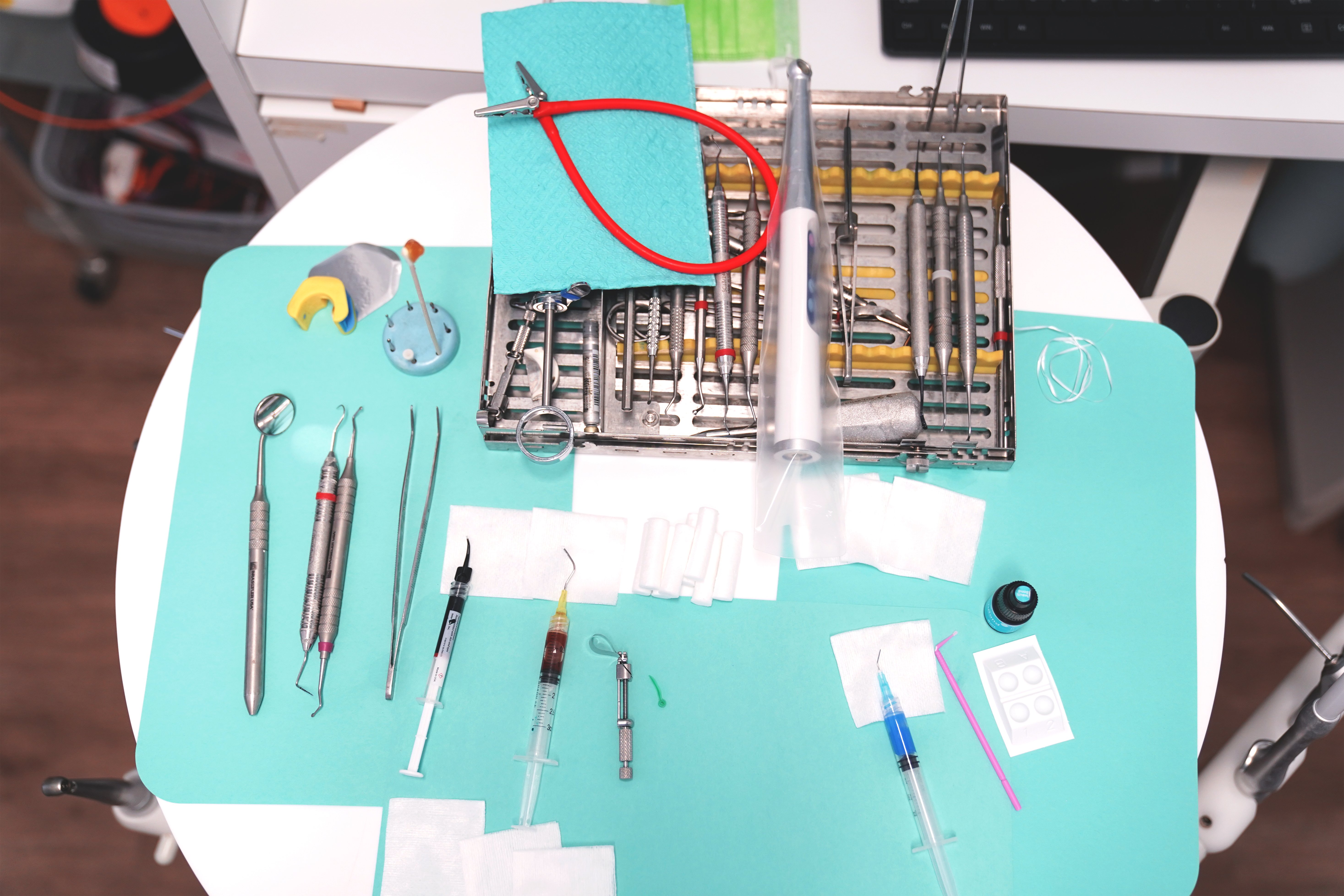

Before you commit to a purchase, take a hard look at how the practice runs day to day. .jpg?width=559&height=373&name=DSC08364%20(1).jpg)

Start with billing, collections, and insurance workflows. Are processes documented, consistent, and understood by the team? Or does everything live in one person’s head? A lack of standard operating procedures creates risk the moment someone leaves or reduces hours.

If you’re unfamiliar with what healthy billing workflows should look like, this overview is a helpful baseline: What is dental billing? An understanding of how dental billing works

Technology matters too—but not just whether it’s new. Ask:

- Is the practice management software fully utilized or barely understood?

- Are reports used to guide decisions, or ignored entirely?

- Are patient balances followed up consistently, or sporadically when time allows?

Many new owners underestimate how much time billing and collections consume. Without support or automation, those responsibilities often fall on already-stretched front office staff—or on you.

That’s why it’s important to explore what tools or partners you may need post-purchase. For example, automated patient payment solutions like QuantaPay can help stabilize cash flow without adding administrative burden.

Finally, evaluate the people side of the practice.

Staffing stability, compensation structure, and culture all affect continuity. A practice with high turnover or unclear roles may look profitable today but unstable tomorrow. Ask yourself whether the team is prepared to navigate an ownership transition, or whether you’ll be rebuilding from day one.

Tip #3: Build the right advisory team before you shop

No matter how capable or prepared you feel, buying a dental practice is not a solo endeavor. The decisions you make as you shop and during due diligence will shape your financial and professional life for years.

Generic advisors can miss dental-specific risks.

Dental-experienced CPAs and attorneys understand nuances like insurance participation, fee schedules, and compliance issues that directly affect valuation and long-term profitability. They don’t just review documents, they interpret them in context.

How advisors protect valuation, contracts, and compliance

The right advisors protect you from paying full price for hidden risk.

Dental-specific CPAs help ensure valuation reflects *collectible revenue*, not just production on paper. They normalize financials, flag unsustainable write-offs or staffing costs, and surface trends that may change once ownership transitions.

Experienced dental attorneys safeguard the deal itself. They review contracts, lease terms, and compliance exposure to make sure you’re not inheriting restrictions or liabilities that limit your ability to operate, renegotiate payers, or grow post-purchase.

One often-overlooked area is payer mix and PPO participation. Fee schedules that look acceptable today may limit future growth if they aren’t renegotiated or strategically managed. This resource explains why that matters: How to negotiate a better PPO dental fee schedule

Together, advisors help ensure the value you’re buying is real, durable, and legally sound — not dependent on past habits you won’t inherit.

When to involve revenue cycle experts during due diligence

Revenue cycle experts should also be part of the conversation before the purchase, not after.

During due diligence, they assess how reliably the practice converts production into cash — reviewing A/R aging, billing workflows, payer behavior, and follow-up processes. These insights often reveal revenue risks that don’t appear in high-level financial summaries.

Catching issues early gives you leverage to renegotiate terms, plan realistic working capital, or require cleanup before closing. Waiting until after the sale turns manageable inefficiencies into immediate pressure.

Early involvement brings clarity, not delay — and helps you step into ownership with a plan instead of a scramble.

The right advisory team doesn’t just protect you from bad deals. They give you leverage, clarity, and confidence when it’s time to make a decision.

Start your journey with your new practice successfully

Buying a dental practice is exciting but excitement has a way of clouding judgment, and so does pressure. Listings move quickly. Sellers push timelines. Financing approvals expire. In those moments, preparation matters more than speed.

A successful purchase starts with preparation, not pressure.

When you understand the financial reality, operational strength, and risk profile of a practice, you’re better equipped to decide whether it’s a good buy—or a goodbye. Knowledge across these three areas doesn’t just reduce risk; it creates sustainability.

To recap, here are the key areas to evaluate before you move forward:

- Tip #1: Look beyond production and assess true financial health

- Tip #2: Evaluate operations, systems, and people—not just the facility

- Tip #3: Build the right advisory team before you shop

Ownership can absolutely be rewarding—financially and professionally—when the foundation is solid. And you don’t have to figure it all out alone.

If you’re preparing to buy a practice and want a clearer picture of what you’re stepping into, we’re here to help. Get a free Collections Analysis by our revenue experts

We’ll help you move forward with confidence, as well as build a practice that supports you and your community for the long haul.

Related Posts

Dental revenue resources from Dental Claim Support